Celebrating the Investment Reverberation Act

Sure, inflation has been reduced from 8.3% to 3.2% since the passage a year ago of the “Inflation Reduction Act” (IRA). But the intended purpose of the IRA was bigger than short-term inflation reduction. Its impact on the economy and the climate will reverberate for decades to come. So maybe a better name would be something like the “Investment Reverberation Act”.

In just one year, the IRA has already made an impact:

- 170,600+ new clean energy jobs

- 272 clean energy projects in 44 states

- on path to cut pollution 50% by 2030

This strong start is consistent with the expectations published in a Brookings Institution report titled “Economic Implications of the Climate Provisions of the Inflation Reduction Act”. Brookings said “we find that the Act could energize the economy and decarbonization efforts. It has the potential to lower energy costs, contribute to lower inflation, increase productivity, and raise economic output over time.”

The full “Investing in America Agenda” – including the American Rescue Plan, Bipartisan Infrastructure Law, CHIPS & Science Act, and Inflation Reduction Act (IRA) – is mobilizing historic levels of private sector investments across the country, bringing manufacturing back to America after decades of offshoring, and creating new, good-paying jobs.

In Seattle yesterday, Vice President Kamala Harris celebrated the first anniversary of the IRA’s passage and said, “Since we took office President Biden and I have created more than 13 million new jobs. Including nearly 400,000 jobs right here in Washington state. Today, the unemployment rate is near the lowest it has been in half a century. Inflation is down and wages are up.”

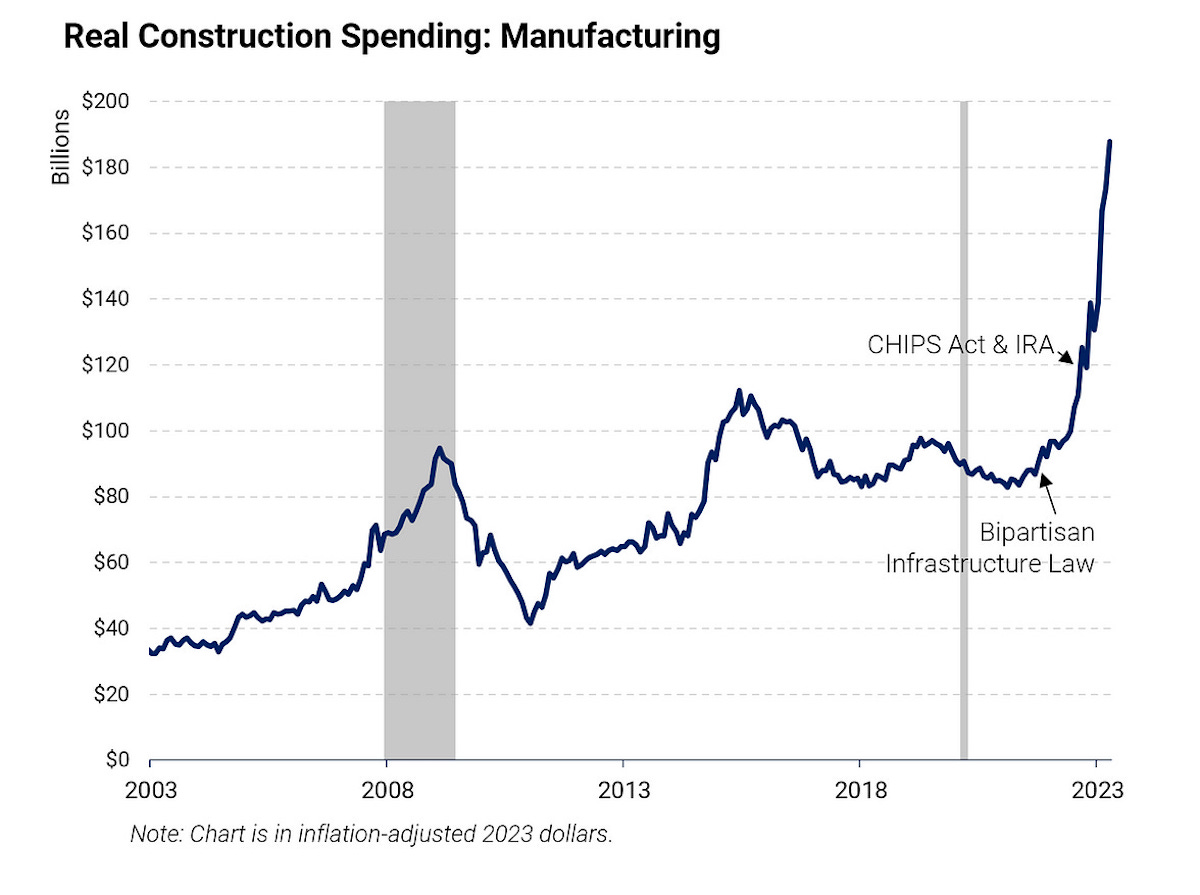

Speaking about the Investing in America Agenda, she added, “This work was designed to dramatically expand solar and wind energy production, to lower energy costs for working families and to put millions of electric vehicles on the road, including thousands of electric school buses so that our children can have clean air to breathe. And it is with these investments that we are creating millions of good paying clean energy jobs. We are rebuilding America’s manufacturing. And we are driving American innovation, something this state knows so well.”

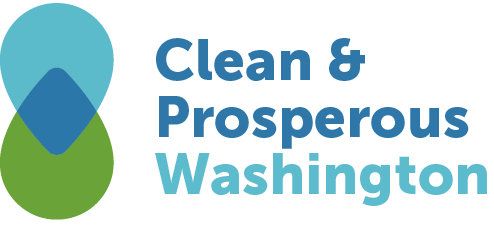

On the subject of driving American innovation, RMI writes in “Congress’s Climate Triple Whammy: Innovation, Investment, and Industrial Policy”,

“It is not just the sheer volume of spending, but its strategic application that could be transformative. Even more important than where funding is allocated by sector, is when it is allocated in the technology adoption curve. To be a little more precise, the transition to any new technology, including clean energy alternatives, typically occurs in phases, which are commonly represented in an S-Curve of technological adoption over time.

The public policy approach, therefore, needs to be “entrepreneurial,” in the sense of encouraging failed attempts and embracing risks that are untenable for private capital funders. Without the ability to learn from failures, these hiccups along the way will slow innovation and postpone the adoption of the solutions we need.

What’s so striking about the climate legislation enacted during the 117th Congress is how closely it has followed this advice. The provisions in the three bills invest throughout the adoption curve, encourage innovation at break-neck speed, back multiple technological solutions, and embrace risk. The figure below shows the total spending of all climate-related provisions in the three bills, categorized by their expected impact along the S-Curve of technological adoption. As one might hope, spending is concentrated in the first four phases, where private markets are less likely to invest in research, development, demonstration, and early commercialization.”

These early-phase, “entrepreneurial” investments are intended to prime the pump, and catalyze private investments at an even greater scale.

The World Resources Institute reports,

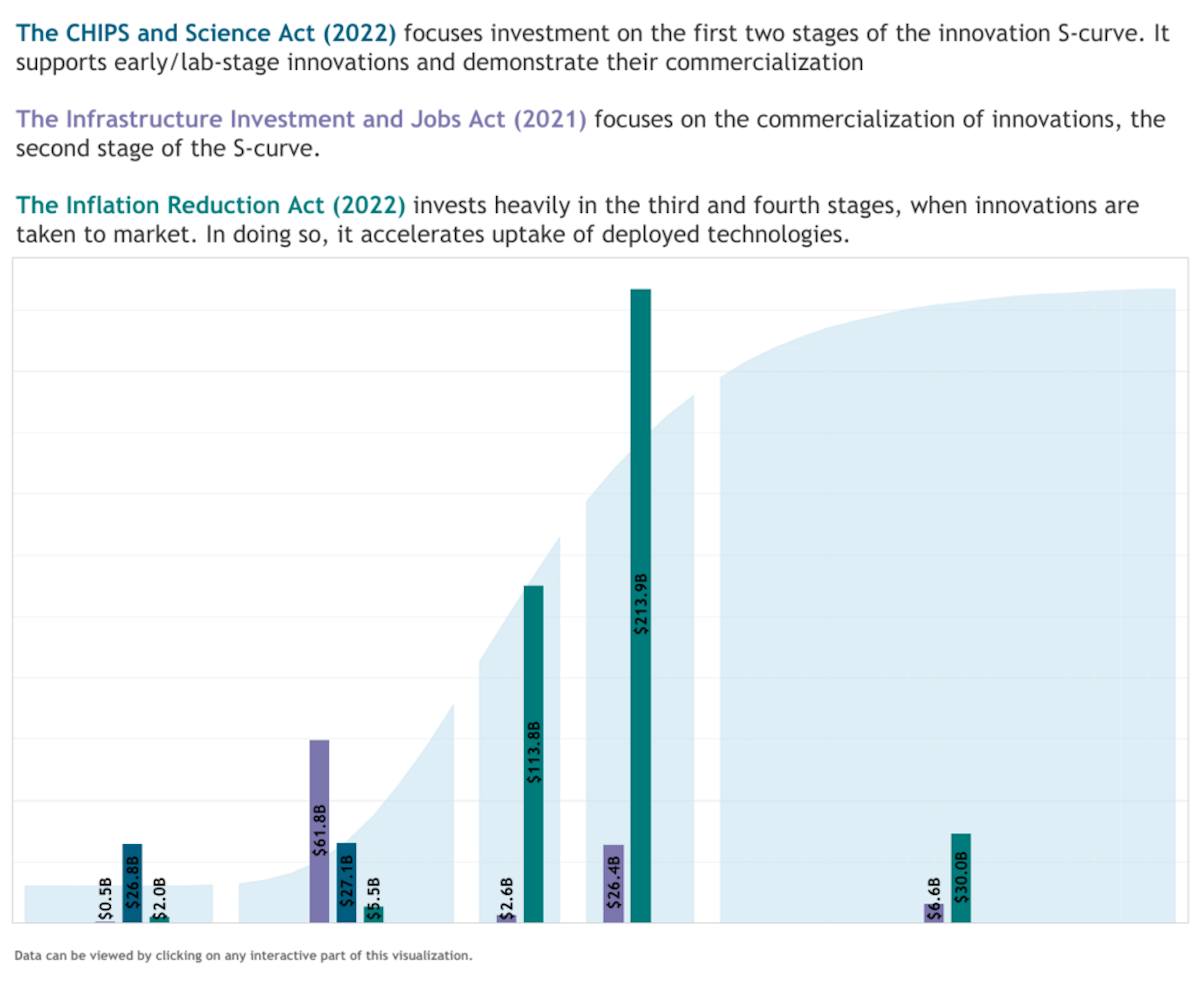

“The law has already unleashed a manufacturing renaissance by nearly doubling the amount of manufacturing construction in just one year, with forecasts of even higher growth in years to come. Since its passage, makers of battery components, wind and solar equipment, and electric vehicles have announced tens of billions of dollars of new investments, bringing significant local opportunities with them. Between August 2022 and July 2023 alone, 272 new clean energy projects were announced in 44 states. These will generate more than 170,000 new jobs in small towns and big cities alike with Michigan, Georgia, South Carolina, California and Texas leading the way.

Though spurred by incentives in the Inflation Reduction Act, much of this new investment comes not from federal dollars but from the private sector. States and local governments have long used tax credits and other incentives to entice private and public investments into their communities. Now the federal government is following suit. And because the IRA tax credits are uncapped, the private sector may end up investing more capital in clean energy projects creating more manufacturing jobs than originally predicted.

In the summer of 2022, the Congressional Budget Office forecasted that approximately $369 billion in federal clean energy tax credits may be claimed through the law. However, according to an April 2023 analysis by Goldman Sachs, the now estimated $1.2 trillion in federal incentives may encourage up to $3 trillion in private investment over the next decade, resulting in millions of new, well-paying jobs.”

Look at this remarkable graph from Steven Rattner, using FRED data – the amount of money American companies are spending to build plants and expand here at home has nearly DOUBLED in a single year.

The New York Times reports in The Clean Energy Future Is Arriving Faster Than You Think,

More than $1.7 trillion worldwide is expected to be invested in technologies such as wind, solar power, electric vehicles and batteries globally this year, according to the I.E.A., compared with just over $1 trillion in fossil fuels. That is by far the most ever spent on clean energy in a year.

Those investments are driving explosive growth. China, which already leads the world in the sheer amount of electricity produced by wind and solar power, is expected to double its capacity by 2025, five years ahead of schedule. In Britain, roughly one-third of electricity is generated by wind, solar and hydropower. And in the United States, 23 percent of electricity is expected to come from renewable sources this year, up 10 percentage points from a decade ago.

The TIME CO2 Leadership Report says,

Companies have invested more than $270 billion in U.S.-based clean energy projects—think wind, solar, and battery—since the IRA became law, according to a report from the American Clean Power Association released earlier this week. Electric vehicle technology investment has totalled more than $130 billion, according to White House data. And the private sector is expected to spend trillions more to take advantage of the incentives in the law over the next decade. “People are deploying capital because of the IRA. If you talk to anyone in the finance world, where people are seeing uptake in capital formation is in the clean sectors,” says John Podesta, Senior Advisor to the President for Clean Energy Innovation and Implementation. “And there’s no question that the bill itself has spurred this.”

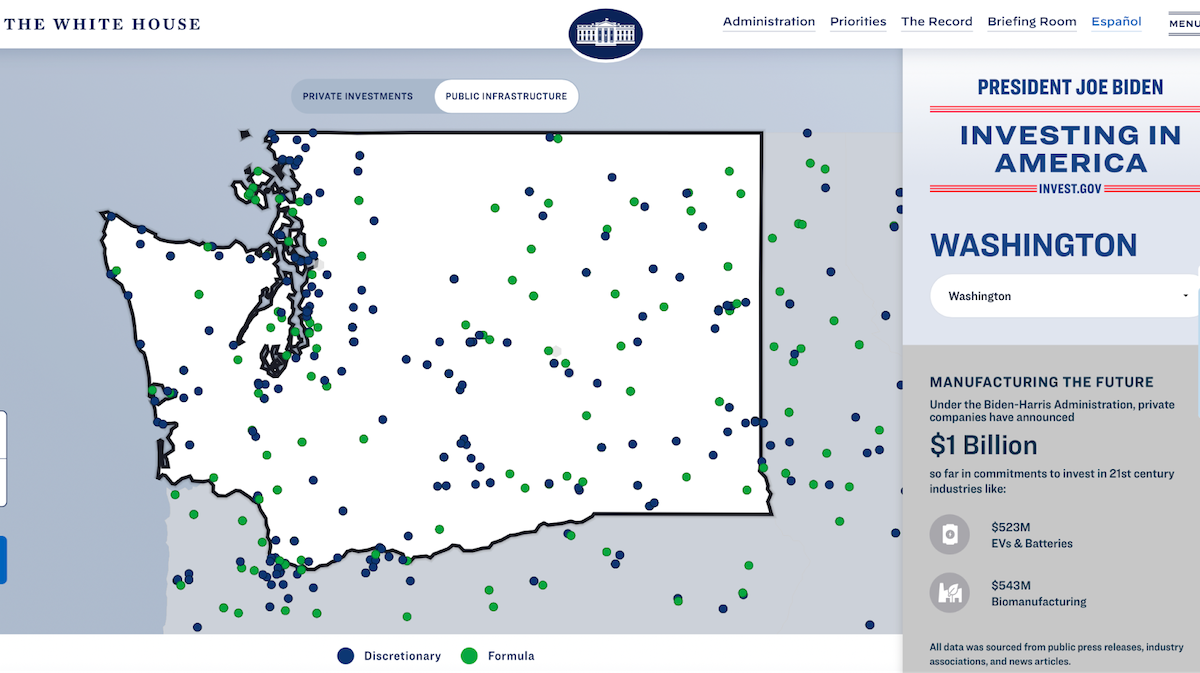

Many of those investments – both public and private – are landing here in Washington state.

Under the Biden-Harris Administration, private companies have already announced $1 billion in commitments to invest in 21st century industries.

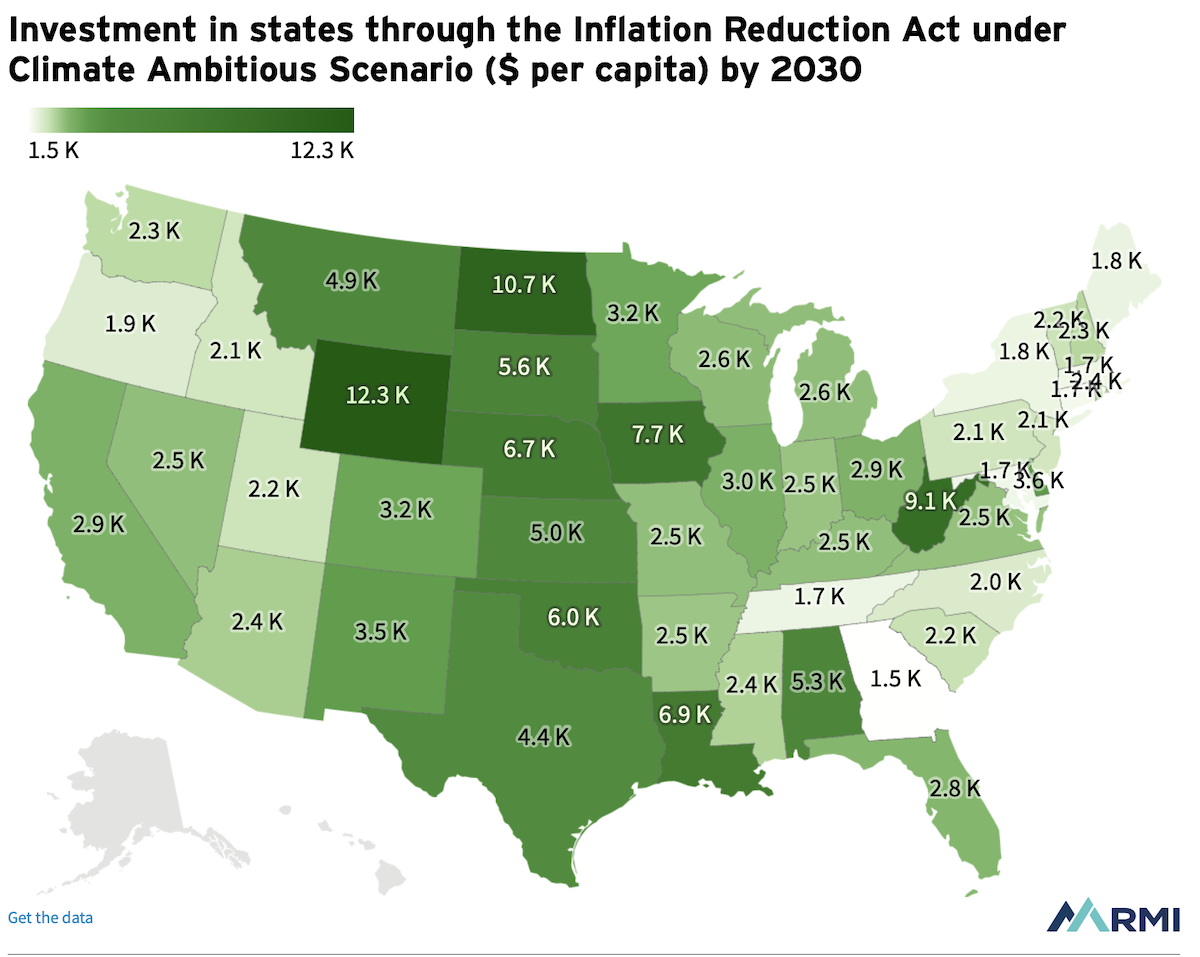

RMI estimates that Washington could secure IRA-related investments of $2,300 per capita between now and 2030.

Clean energy investments are being considered across the state, from Centralia to Moses Lake, to Cherry Point – where bp America is considering an investment of more than $1.5 billion to build two low-carbon facilities; one to produce sustainable aviation fuel, and the other to produce green hydrogen.

Washington State Ferries announced it has awarded a roughly $150 million contract to ship builder Vigor to convert up to three of the state’s largest vessels to hybrid-electric power at Vigor’s Harbor Island shipyard in Seattle.

The Washington State Department of Ecology, in conjunction with the Washington State Department of Commerce, has announced two new programs for funding the installation of electric vehicle charging stations. The programs total $127.5 million in grant funding.

Note that today the Washington State Department of Ecology released the results of last week’s Allowance Price Containment Reserve (APCR) auction under the Climate Commitment Act (CCA). All 1,054,000 emission allowances were sold, raising $62.5 million which will fund further state investments in accelerating the transition to a clean economy.

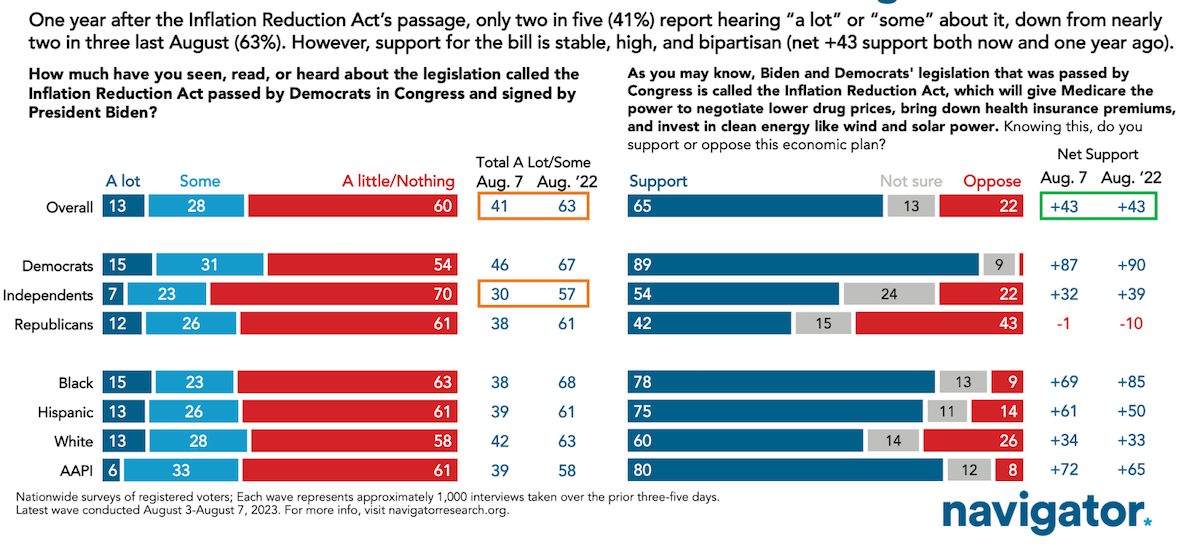

Here’s one last chart for you:

Most Americans have heard “a little or nothing” about the Inflation Reduction Act. So please consider forwarding this newsletter to your network of friends and colleagues, to help spread the word about how public policy is spurring private investments that are powering our clean energy future.

Know someone who’d be interested in keeping up with climate action in the Evergreen State? Please forward this newsletter and suggest they subscribe with this link.

Register now for the next Fleet Decarbonization Accelerator, offered by the Breaking Barriers Collaborative. Learn about fleet decarbonization and create an action plan to transition your fleet – large or small – to clean energy.

Visit the Breaking Barriers Collaborative website to Learn More about the Accelerator and sign up for an upcoming information session, held on Aug. 30, Sept. 13, and Sept. 27 from 12-1pm Pacific Time.

The Washington Department of Ecology has posted a public notice to the CCA Auctions and Market webpage outlining the date and time of the third cap-and-invest auction, as well as other important information.

Stay up to date with what’s being done to implement the Climate Commitment Act. Click HERE to read the most recent edition of the Department of Ecology’s blog series, “Meaningful Momentum,” which provides regular updates on various aspects of this effort.